“I Looked Down for a Second” — How Comparative Fault Can Still Get You Paid in Oregon

“I Looked Down for a Second” — How Comparative Fault Can Still Get You Paid in Oregon

It’s one of the most common thoughts after a crash: “I looked down for a second.” Maybe it was a GPS prompt, a quick glance at the dashboard, or a moment of distraction in the chaos of city driving. That split second can make you feel like you lost your chance to recover anything at all.

In Oregon, that isn’t how the law works. Oregon uses a modified comparative fault system that still allows recovery as long as your share of fault doesn’t tip over a specific threshold. Understanding how that threshold works—and how insurers fight over percentages—can be the difference between a fair recovery and walking away with nothing.

This guide explains Oregon’s comparative fault law, how fault percentages are assigned, how your settlement is calculated, and what to do immediately after a crash to protect your claim. It also links to trustworthy public sources so you can verify the rules yourself.

Oregon’s Comparative Fault Law (The “51% Rule”)

Oregon’s comparative fault statute is ORS 31.600. It allows a person to recover damages only if their fault is not greater than the combined fault of everyone else. In practical terms, that means:

- 0–50% at fault: You can recover damages, reduced by your percentage of fault.

- 51% or more at fault: You are barred from recovering from the other party.

You can read the statute directly on the Oregon Legislature’s website: ORS 31.600 — Comparative Fault.

This 51% cutoff is why insurers fight so hard over “small” details. Every percentage point changes the value of the claim, and a single point can be the difference between some recovery and no recovery.

How Fault Percentages Are Determined

Fault isn’t decided by who feels guilty—it’s decided by evidence. Insurers (and, if necessary, juries) examine the facts to decide how responsibility should be split.

Common evidence sources include:

- Police reports: Officers document the scene, parties’ statements, and any citations issued.

- Physical evidence: Photos of vehicle damage, skid marks, debris fields, and traffic controls.

- Witness statements: Independent third-party accounts often carry significant weight.

- Traffic laws: Violations like speeding, failure to yield, or illegal turns directly influence fault.

- Video or dashcam footage: Objective footage can confirm speed, signals, or right-of-way.

In short, the story that is supported by the most credible evidence tends to win. Oregon’s comparative fault framework turns these facts into percentages that directly affect your settlement.

How Comparative Fault Changes Your Settlement

Once total damages are calculated, Oregon reduces your recovery by your percentage of fault. Here’s a simple example:

- Total damages: $100,000

- Your fault: 20%

- Your recovery: $80,000

If your fault becomes 51%, your recovery becomes $0, even if the other driver also did something wrong. That “cliff” is what makes fault disputes so high-stakes.

Real-World Examples of Comparative Fault in Oregon

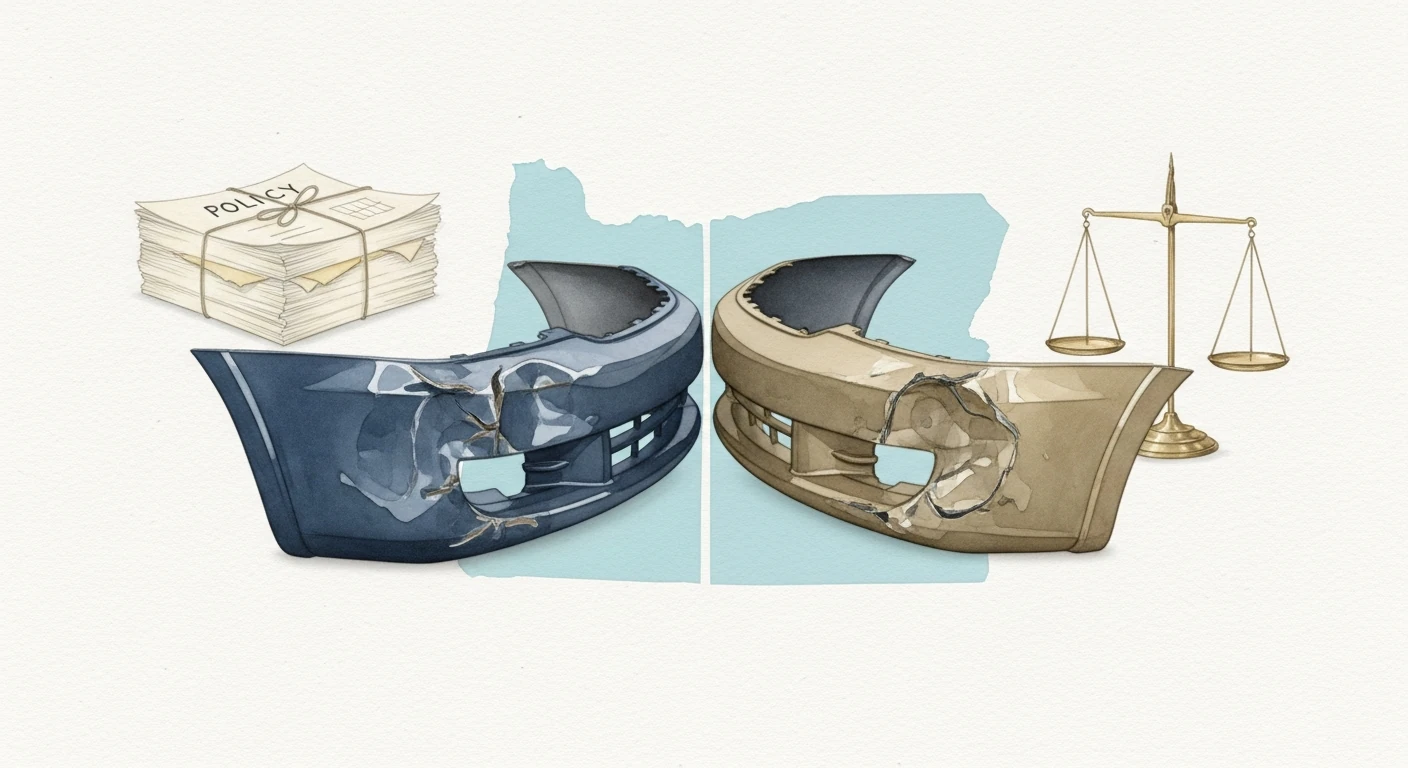

Example 1: Rear-End Collision with a Momentary Distraction

You’re stopped at a red light. You glance down at your phone, the light changes, and the car behind you hits your bumper. The rear driver likely bears most responsibility for following too closely, but the insurer may argue your delayed reaction contributed.

Possible outcome: 90% fault to the rear driver, 10% to you. You still recover 90% of your damages.

Example 2: Failure to Yield vs. Speeding Driver

You pull out from a side street and misjudge an oncoming car’s speed. The other driver was speeding 15 mph over the limit.

Possible outcome: 70% fault to you, 30% to the speeding driver. Because you are over the 50% threshold, you recover nothing under Oregon’s rule.

Example 3: Pedestrian Outside a Crosswalk

A pedestrian crosses mid-block while looking at a phone. A driver traveling at the speed limit is briefly distracted and strikes the pedestrian.

Possible outcome: 50/50 fault split. The pedestrian could still recover 50% of their damages because they are not over the 50% threshold.

How Insurers Use Comparative Fault to Reduce Payouts

Insurance adjusters are not neutral referees. Their job is to protect the insurance company’s bottom line. Because Oregon’s law turns percentage points into dollars, adjusters often:

- Frame your statements as admissions of fault.

- Overemphasize minor mistakes to inflate your percentage.

- Push for quick settlements before all evidence is gathered.

This is why it’s crucial to be cautious about early statements and to document the scene thoroughly.

Steps to Protect Your Claim After a Crash

1) Get Medical Care Immediately

Even if you feel “okay,” seek medical attention. Delays create a gap in treatment that insurers use to argue you weren’t seriously hurt. Oregon requires Personal Injury Protection (PIP) coverage, which pays for medical bills and lost wages regardless of fault, so you can get care without waiting for liability to be decided. The Oregon Department of Consumer and Business Services explains PIP benefits and requirements: Oregon Auto Insurance — PIP Coverage.

2) Document the Scene

Use your phone to capture:

- Vehicle positions and damage

- Skid marks and debris

- Traffic signs, signals, and weather conditions

- Any visible injuries

Objective evidence is your strongest protection against inflated fault claims.

3) Gather Witness Information

Independent witnesses can break a “he said, she said” dispute. Get names and contact details if you can.

4) Be Careful With Statements

Polite does not mean admitting fault. Avoid phrases like “I’m sorry” or “I didn’t see you.” Stick to the facts and let the investigation determine fault.

Oregon Deadlines That Matter

Oregon generally allows two years to file a personal injury lawsuit after a crash. That deadline comes from ORS 12.110, and missing it can end your case regardless of fault. You can read it here: ORS 12.110 — Two-Year Limitations.

Claims should also be reported to insurers quickly under your policy’s notice provisions, so don’t wait to start the process.

Distracted Driving and Why It Matters in Fault Disputes

Comparative fault arguments often revolve around distraction. National data shows distraction significantly increases crash risk, and insurers cite this research when assigning fault. The National Highway Traffic Safety Administration (NHTSA) provides detailed data and prevention guidance: NHTSA — Distracted Driving.

If you were distracted but the other driver committed a more serious violation (such as speeding or running a red light), comparative fault may still allow recovery—as long as your percentage stays at or below 50%.

Frequently Asked Questions

Can I still recover if I was partly to blame?

Yes. In Oregon, you can recover as long as your fault is 50% or less, but your recovery is reduced by that percentage. See ORS 31.600.

Who decides my percentage of fault?

Insurers make the first determination. If the case goes to court, a jury can assign fault percentages based on the evidence.

Does PIP coverage apply even if I caused the crash?

Yes. Oregon requires PIP coverage, which pays medical expenses and certain lost wages regardless of fault, up to your policy limits. See the Oregon Department of Consumer and Business Services for details: Oregon Auto Insurance — PIP Coverage.

What if the other driver had no insurance?

Your policy may include uninsured or underinsured motorist coverage, which can still provide recovery even when the at-fault driver lacks coverage. The Oregon DMV provides an overview of required coverages: Oregon DMV — Insurance Requirements.

Key Takeaways

- Oregon uses modified comparative fault with a strict 51% cutoff. ORS 31.600

- Your recovery is reduced by your percentage of fault.

- Evidence and documentation are critical for keeping your fault percentage low.

- Oregon generally allows two years to file a personal injury lawsuit. ORS 12.110